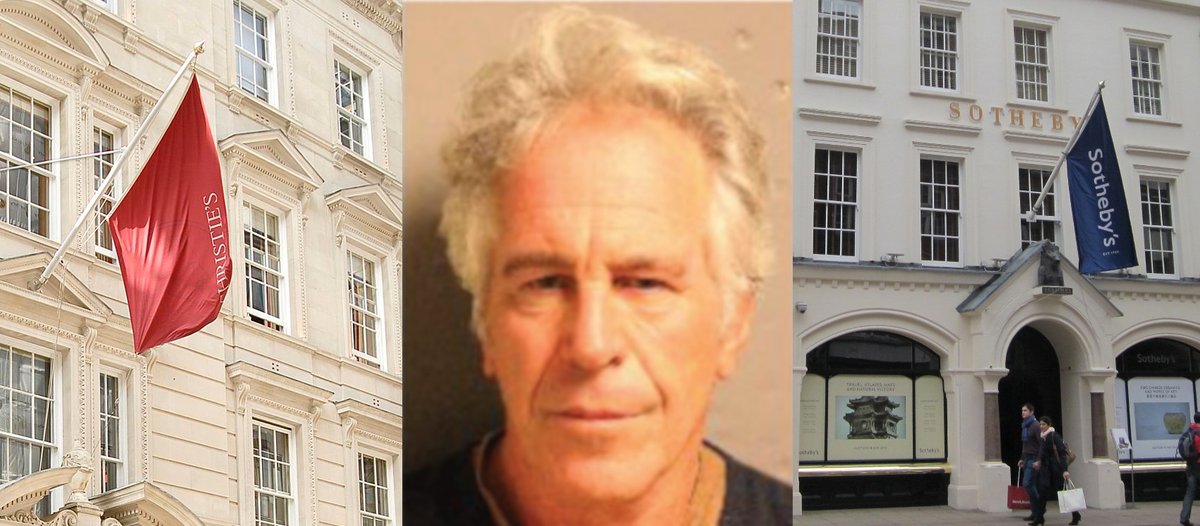

As part of a civil forfeiture suit against Jeffrey Epstein, Christie’s and Sotheby’s were last week ordered by prosecutors in the US Virgin Islands to disclose all correspondence and dealings with the late convicted paedophile going back more than 20 years.

Denise N. George, the attorney general of the US Virgin Islands, alleges Epstein misled government officials to secure lucrative tax breaks for his businesses while engaging in sex trafficking and the abuse of underage girls. More than 70 women are reportedly now in line to receive money from a compensation fund from Epstein’s estate—worth $600m when he died last summer in custody while facing sex-trafficking charges. Epstein’s death was ruled a suicide.

In court documents filed on 2 December, Christie’s and Sotheby’s were asked to release “all documents reflecting or relating to inquiries, sales, bids, communications with or about Jeffrey E. Epstein”; any “financial information” relating to those inquiries, sales or bids; and all documents “reflecting or relating to the tax treatment or transfers to other entities for artwork or other objects” by Epstein or his agents including the executors of his estate, Darren Indyke and Richard Khan. A fourth request has been heavily redacted. Both Christie’s and Sotheby’s declined to comment.

As first reported by Chris Spargo in OK! magazine, a third firm, the Chicago Deferred Exchange Company, was also ordered to disclose the same information as Sotheby’s and Christie’s. In addition, the Illinois company was requested to hand over all records relating to a tax audit focusing on the period June 2015 to November 2016, during which time two watercolours by Paul Cézanne and one painting by Pablo Picasso were sold with a combined value of $139m.

It is not clear how—or indeed whether—Epstein was involved in the Chicago Deferred Exchange Company, which is described as “a third-party” in court documents. The tax audit refers to a seemingly related entity with a different name, CDECRE Artwork EAT, also with headquarters in Chicago, which “provides intermediary and exchange accommodation titleholder services to investors seeking to defer gain”.

The tax audit, filed in March this year, reveals how CDECRE improperly calculated the sales tax on the paintings by Cézanne and Picasso using “trade-in credits” for other works of art exchanged as part of the deals. CDECRE claimed to be a “vendor” in the deals, which the tax office disputed, saying that fact could “not be determined based upon the limited record” of the audit. Regardless, the tax division concluded that CDECRE was responsible for collecting the payment of $3.6m in outstanding taxes, on top of $8m which had already been paid.

According to the court documents, one of the Cézannes was sold to Narrows Holdings, a company that Leon Black, the chairman of the Museum of Modern Art in New York, has used to purchase much of his billion-dollar art collection. The other watercolour by Cézanne went to AP Narrows, which has also been associated with Black, who is not suspected of any wrongdoing. It is not known who received the Picasso painting.

In September, Black was subpoenaed by prosecutors in the US Virgin Islands seeking financial statements and tax returns from his companies in a bid to understand Black’s decades-long business ties with Epstein.

Black’s spokeswoman, Stephanie Pillersdorf, declined to comment on the tax audit, but previously told the New York Times: “Mr Black received personal trusts and estates planning advice as well as family office philanthropy and investment services from several financial and legal advisers, including Mr. Epstein, during a six-year period, between 2012 and 2017.”

She adds: “Mr. Black continues to be appalled by the conduct that led to the criminal charges against Mr. Epstein, and he deeply regrets having any involvement with him.”