Yuga Labs, the start up that created the wildly lucrative Bored Ape Yacht Club (BAYC) NFTs, is reportedly in financing talks with the US venture capital firm Andreessen Horowitz that would value it at between $4bn and $5bn.

While talks are ongoing, meaning exact terms of the deal are subject to change, Yuga Labs is looking to sell a multi-million dollar stake in a new funding round, according to the Financial Times. This would mark the first instutional investment in the mysterious creative collective, whose four founders operate under the psuedonyms Gordon Goner, Emperor Tomato Ketchup, No Sass and Gargamel. Incorporated in February 2021, Yuga Labs has 11 employees.

Neither Yuga Labs nor Andreesen responded to The Art Newspaper's requests for comment.

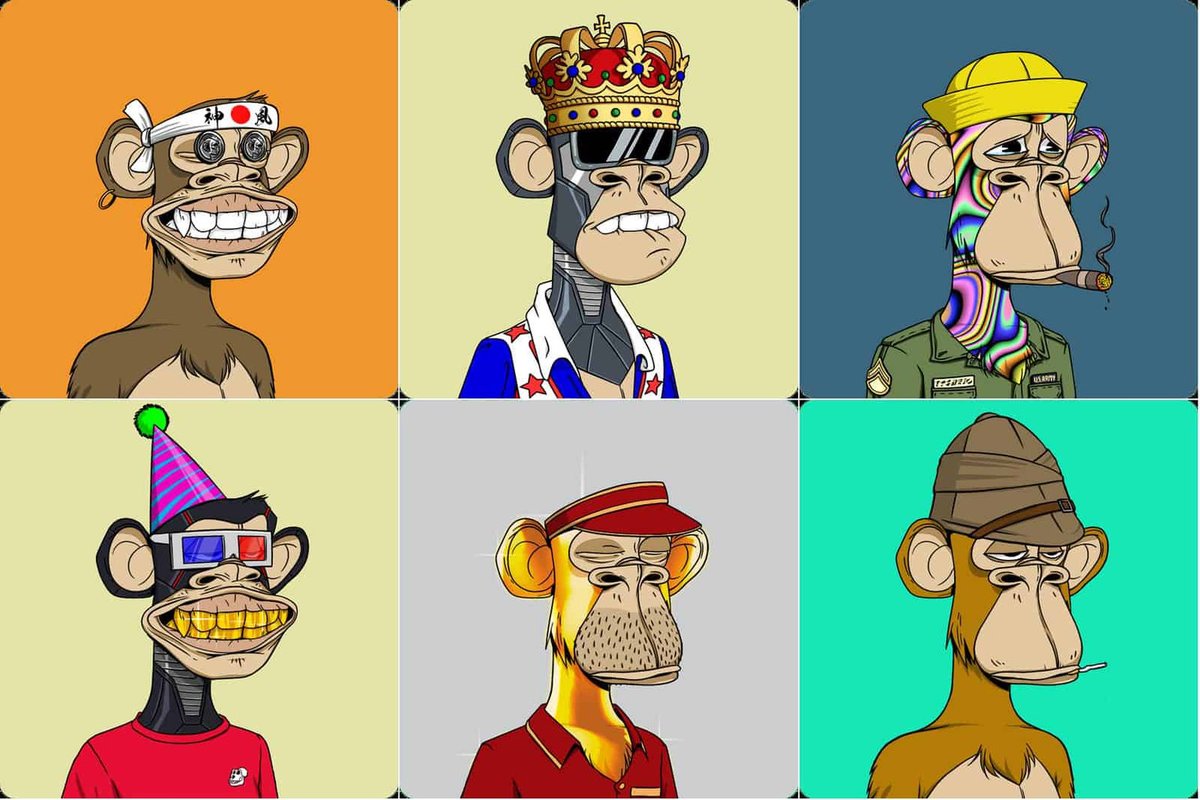

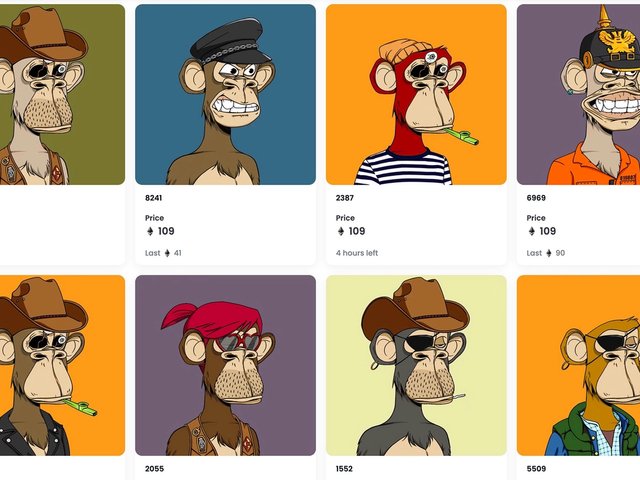

Launched last April, the Bored Apes are a set of 10,000 digital images of apathetic apes minted as Ethereum NFTs. They have generated more than $750m worth of trading volume and count celebrities such as Paris Hilton and Snoop Dogg as holders. The record sale for a single Bored Ape NFT is 740 ETH, or $2.9m, in September 2021. It was purchased by the developer of the upcoming Ethereum game, The Sandbox. Earlier this week, the singer Justin Bieber purchased a Bored Ape for nearly $1.3m, 300% more than its valued market price.

Purchasing a Bored Ape grants holders access to an exclusive Discord server, as well as the ability to use their ape as a profile picture on social media. Yuga Labs collects a cut of each Bored Ape resale.

Andreessen, an early investor in other tech startups such as Facebook and Airbnb, is a major shareholder in cryptocurrency exchange Coinbase and the NFT exchange OpenSea.

This huge prospective investment is the latest instance of a major venture capital fund claiming stakes in NFT art and Web3. Last week, the curated NFT art platform TRLab, launched in May, raised $4.2m in a new funding round. Investors include Pace and its metaverse wing Pace Verso, and former Christie's co-chairman Loic Gouzer, who recently launched the NFT fractional ownership company Particle.