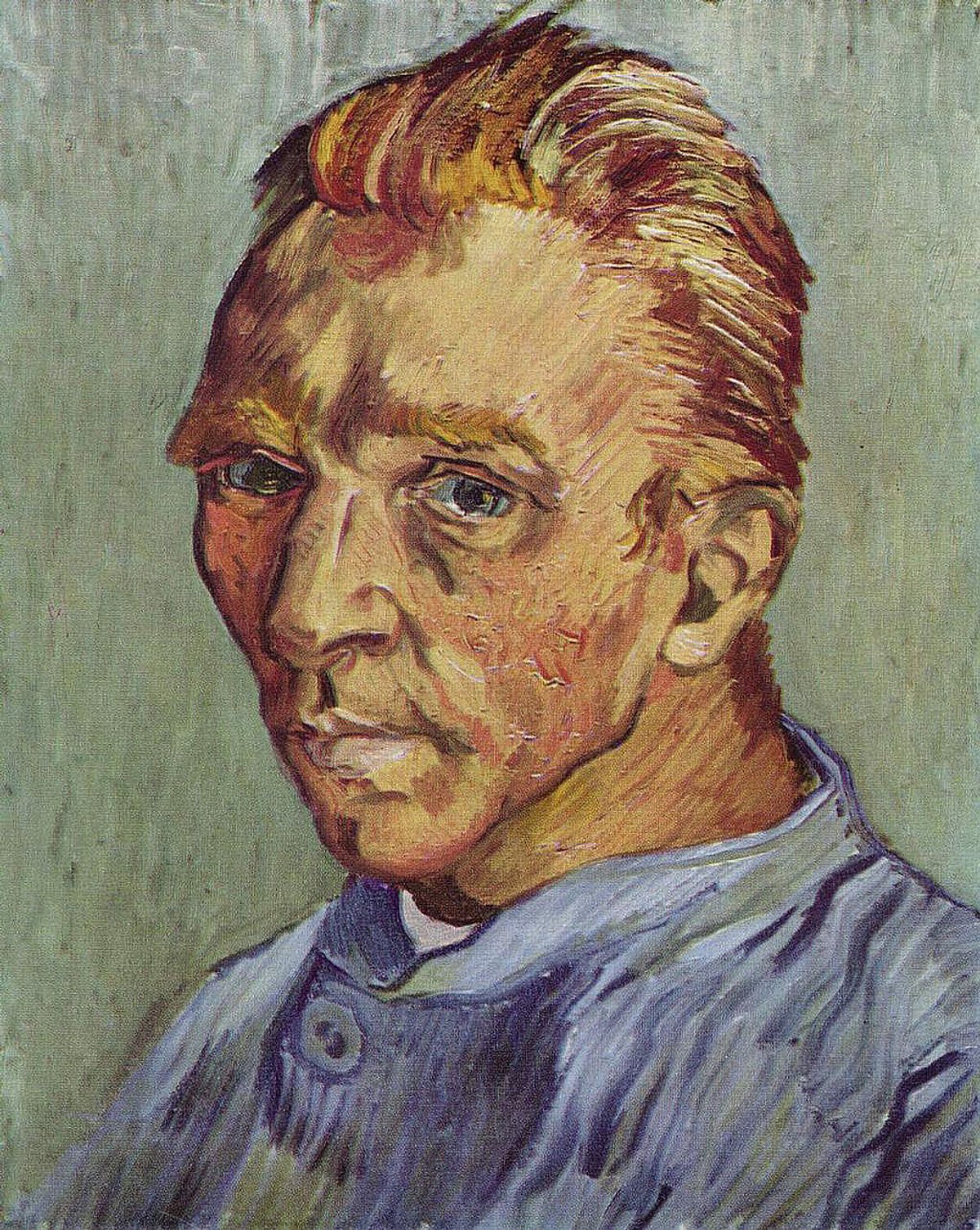

After an extraordinary binge during the late 1980s, culminating in the two highest prices ever paid for paintings at auction (Van Gogh’s Portrait of Dr Gachet, $82.5mn, and Renoir’s Au Moulin de la Galette, $78.1m, both bought by the Japanese paper mogul Ryoei Sito), the art market came to an abrupt halt after June 1990, as the Japanese withdrew from buying art and the Gulf War started in the Middle East.

1991

January: The Itoman scandal breaks: massive sales of over-priced art are revealed to be funded by Japan’s Sumitomo Bank for the trading company Itoman. The scandal is a key element in the sudden Japanese withdrawal from the art market

March: The Japanese Gallery Urban files to liquidate its assets, while the major Swedish collector Hans Thulin files for bankruptcy. The London Scandanavian art sales, which had collapsed in 1990, are cancelled.

April: The third major art scandal breaks in Japan as the taxman investigates Mitsubishi Corporation for using art to evade tax.

Sotheby’s and Christie’s 1990 year-end figures show a dramatic fall in profits due to slumping sales.

May: New York assemblyman Richard Brodsky’s attempts to regulate the art trade more closely, including outlawing "chandelier" bids and secret reserves, are rejected by the NY Bar Association. However some provisions are later adopted.

September: Ader Picard Tajan, France’s leading auction firm, splits.

December: Titian’s Venus and Adonis sells at Christie’s for £7.48m ($13.4m), but the anaemic results at the Modern and Impressionist art sales cast fresh gloom on the market.

Hit by the collapse of the Scandanavian market, the two Swedish auction houses, Bukowski’s and Beijer’s, merge.

1992

January: Heavy sentences are imposed on the defendants of the Diego Giacometti forgery trial. It is thought that over 65% of the artist’s furniture sold at auction since 1986 is fake.

February: The Geneva auction house Hapsburg closes.

April: Leading French auctioneer Jean-Louis Picard sets up a new business, a year after his split with Ader and Tajan.

The National Gallery buys Holbein’s Lady with a Squirrel, for £10m ($17.4m). The most expensive picture consigned to auction in the year, it was withdrawn from Christie’s by seller Lord Cholmondeley and sold privately. Sotheby’s and Christie’s reveal a massive drop in profits for 1991.

May: Old Master prices remain solid in New York and London, and an El Greco sketch reaches £1.87m ($3.3m), making a new record for a Spanish painting.

June: Sotheby’s chairman Alfred Taubman sells 36% of his shares in the company to raise funds to prop up his retail businesses.

November: Sotheby’s announces a loss of $7.7m (£5m) for the first nine months and raises its buyers’ premium. Christie’s follows suit in December.

1993

January: Christie’s New York successfully sells the now defunct Itoman corporation’s collection of Modern and contemporary Japanese oils, although the $2.7m (£1.76m) generated is barely 0.5% of the $520m (£338m) allegedly paid by Itoman staff for the art.

April: Christie’s buys the art dealer, and its neighbour, Spink & Son for £7m ($10.71m).

May: Christie’s’ sale of German art makes a total of £16.78m in London. New records are set for Caspar David Friedrich, Emil Nolde and Ernst Ludwig Kirchner. In New York, contemporary sales are weak with Sotheby’s raising just $8.1m—a sobering drop from the $89.4m it made in the November 1989 peak.

October: Top art galleries Wildenstein & Co and the Pace Gallery merge to create a powerful new dealership.

November: New York’s Impressionist and Modern sales are boosted by 88 Picassos from the Seeger Collection. The two Part I sales make $131.9m (£88.5m).

Diana D. Brooks becomes president and CEO of Sotheby’s.

December: Britain loses a four-year battle to prevent VAT being imposed on works imported from outside the EC. The auction houses hope that the new tax rates will not drive trade from Britain.

1994

January: Sotheby’s London sale of the late Peter Sharp’s estate illustrates the continuing resilience of Old Masters. The 20 paintings reach a total of $13.6m (£9.1m) with only two lots left unsold.

Venetian art dealer Semenzato goes bankrupt.

March: Driven by the rise in the buyer’s premium, Sotheby’s and Christie’s report improved profits in 1993, with an increase of sales in London and New York.

July: New record set for an antiquity when an Assyrian relief from Nimrud, discovered in a British school, sells for £7.7m ($11.86m). It goes to Japan's Miho museum.

November: Top French auction house Ader Tajan splits for the last time, leaving Jacques Tajan as sole boss of the firm.

Part I Impressionist and Modern art sales in New York raise $220m (£138m).

December: British Rail sells off the last major chunk of its art fund and reaps £6.76m ($10.55m), announcing a return of 6% over 20 years—less than what it would have earned on the stock market.

1995

February: The Museum of Modern Art in Tokyo reveals the inflated prices it paid for 39 works, using taxpayers’ money.

March: Christie’s announces a new schedule of commission charges to sellers: Sotheby’s essentially matches the rates in April.

May: The Impressionist and Modern art auctions in New York bring in over $200m (£127m), with Picasso’s portrait of Angel Fernandez de Soto making $29.15m (£18.6m).

July: British National Lottery funds the acquisition of 26 paintings from the Roland Penrose estate. In 1995-96 the lottery raises £300m ($480m) for the National Heritage Memorial Fund.

September: PaceWildenstein purchases photography gallery McGill.

October: Sotheby’s photography sale in New York makes $2.59m and sets a new record for Man Ray.

November: The French government says it will end the auction monopoly, after two years of pressure from the EC, and schedules this for early 1998. Promises, promises: the end only comes in 2001.

Ryoei Saito, the owner of the world’s two most expensive paintings (Van Gogh’s Portrait of Dr Gachet and Renoir’s Au moulin de la galette) gets a three-year suspended sentence for bribery. He dies the next year, leaving no will; the paintings are already thought to have been taken by his bank, against massive unpaid loans.

1996

March: In a landmark ruling, the French collector Jacques Walter is granted compensation for his loss over a Van Gogh painting. The case sets a major judicial precedent, blasting a hole in the French system of retaining art by refusing export permission without compensation.

June: Sotheby’s announces its acquisition of the André Emmerich Gallery.

July: The British Rail Pension Fund reports a 13.11% return per annum (5.33% in real terms) on its art fund as it disposes of Old Master drawings, paintings and works of art; the Bute sale of furniture and works of art totals £10.7m at Christie’s.

August: Alan Bond, the Australian businessman, is convicted of fraud and sentenced to three years in prison. In 1987 he had bought Van Gogh’s Irises for $53.9m (£33m) at Sotheby’s but it was later revealed that part of the price was lent by Sotheby’s; the painting was never paid for and subsequently went to the Getty for a price in the region of $53m.

October: A cracked Korean vase sets a new record for an Asian work of art when it sells at Christie’s for $8.4m.

1997

February: A British TV programme reveals that Sotheby’s illegally removed a painting out of Italy and was dealing in smuggled antiquities. The company promises a “full review” of its practices.

May: The American Department of Justice subpoenas Sotheby’s, Christie’s and New York dealers in an investigation into auction house collusion and bid rigging. This becomes a ticking time bomb that will explode three years later (see 2000).

June: Claude Monet’s Nymphéas makes £19.8m ($33m) at Sotheby’s, London.

September: Sotheby’s acquires 50% of Deitch Projects, a cutting-edge, New York art gallery.

October: The most high-profile of a number of departures from Sotheby’s is Simon de Pury, who leaves with his colleague Daniella Luxembourg to found a private dealership.

November: Good times are here again: the Ganz Collection of Modern paintings brings a sensational $206.52m (£122m) at Christie’s New York.

1998

January: Christopher Weston sells the world’s number three auction house, Phillips, to Britain’s venture capital group 3I.

June: François Pinault buys Christie’s: the French businessman, who is also a keen collector of Modern art, pays £721m ($1.171bn) for the company, which he takes private.

June: A Paris court liquidates the Paris practice of Guy Loudmer, one of France’s leading auctioneers. He was under legal investigation for wrongdoing connected with the 1990 Bourdon sale of Modern and Fauvist paintings.

November: The resort owner Steve Wynn unveils the $285m (£171.4m) collection of Impressionist and Modern art exhibited in the gallery of his new Las Vegas hotel and casino complex, the Bellagio. The art belongs either to his company, Mirage Resorts, or is leased to it by Wynn from his personal collection.

. New price highs were set for four other artists in a surging market.

1999

January: Sotheby’s announces it will sell art online and offers dealers exclusive agreements to sell their wares on its new site; 1,500 sign up. Christie’s decides not to try to sell art online.

April: Acquisitions budgets for many publicly funded museums in Japan are slashed as the country’s economy continues to flounder. Nikkei Art, Japan’s only art market magazine, ceases publication.

However, Sotheby’s stock reaches its all-time high of $47.

May: San Francisco giant auction site eBay buys the 134-year-old auction house Butterfield & Butterfield for $260m (£161m). Predictions for the future of internet auction sales are dizzying, with analysts talking about a $19bn market.

As the Dow Jones passes the 11,000 mark, contemporary art auctions in New York are very strong, with particular interest in younger photographers such as Ruff, Gursky or Dykstra.

June: Sotheby’s holds its first sale in France, using French auctioneers, and is rewarded with $26.5m for the contents of the Chateau de Groussay.

November: As the Nasdaq soars (up 80% in one year) money piles into the art market: Impressionist and Modern art auctions total $402.8m (£249m) with two Picassos, from the Madeleine Haas Russell estate, making $49.5m and $45.1m. The French luxury-goods company LVMH, owned by Bernard Arnault, buys the 200-year-old London auction house and world number three, Phillips, for £70m ($112m).

December: Chris Davidge, the chief executive of Christie’s, announces he is leaving the company.

The European Court of Human Rights in Strasbourg rules that the Italian State acted unjustly in forcing the Swiss dealer Ernst Beyeler to sell Van Gogh’s Gardener to it for L600m in 1988, a decision that could lead to the freeing up of art export rules in EC countries.

2000

January: The collusion case bursts: Christie’s turns over evidence relating to collusion in price-fixing with Sotheby’s, 1993-97, and gains immunity from prosecution. The evidence is thought to be contained in 500 pages of notes taken by Chris Davidge and handed over to the US Department of Justice. Customers of both Sotheby’s and Christie’s start civil action lawsuits, seeking reparation for being overcharged. They will settle for a total of £512m in 2001.

February: Sotheby’s owner A.A. Taubman, and Diana D. Brooks resign as chairman and chief executive of the company respectively.

March: MGM buys Mirage Resorts from Steve Wynn and announces it will sell most of the art in the Bellagio Art Gallery.

August: Britain reaches agreement with the European Union on artists’ resale rights: it will be implemented in 2006 on living artists’ work, on a sliding scale and capped at £7,700 ($11,600).

September Bonhams and Brooks merge.

October: Diana D. Brooks, the former chief executive of Sotheby’s, pleads guilty to breaking US antitrust laws by conspiring with Christie’s to fix seller’s commissions. She claims, however, that she only did it “at the direction of a superior”, thus implicating her former boss, Alfred Taubman.

Phillips makes a number of high profile appointments to its board as part of its attack on the high end of the market.

November: At the New York sales, Phillips’ auctions are conducted by Simon de Pury, of the Geneva-based de Pury & Luxembourg art dealership. All of the works in the sale bear some sort of guarantee or financial interest and it makes $32.63m.

Picasso’s brooding Blue Period Femme aux bras croisés makes $55m at Christie’s.

The contemporary art sales are a triumph, with Damien Hirst’s butterfly painting In love, out of love making $680,000 (£475,000) at Phillips, while Charles Ray scores a staggering $2.2m for a full-size, naked model of himself.

December: The French luxury-goods mogul Bernard Arnault stuns the art market by announcing the acquisition of De Pury & Luxembourg, the Swiss art dealership, and is to merge it with Phillips. Rembrandt’s Portrait of a lady, aged 63, makes £19.8m ($28.67m) at Christie’s in London, the second highest price ever paid for an Old Master painting.

2001

January: Drouot, the Paris auctioneers grouping, reports a 14% increase in sales of art and antiques.

March: Figures compiled by the London-based Art Market Reseach Index indicate that 2000 was a boom year for the sale of art, with contemporary art, Old Master painting and German Expressionism shown as the strongest sectors in an overall buoyant market. Sotheby’s reports its largest ever loss of $189.6m (£131.2m) and sales of $1.93bn, while Christie’s overtakes it with sales of $2.32m (as a private company, Christie’s does not report profits and losses).

May: Phillips emerges second in the line up after the Modern and Impressionist art auctions, with $124m, in a sale heavy with guaranteed lots including seven from the collection of the German dealer Heinz Berggruen. Sotheby’s is first and Christie’s comes into third place. Max Beckmann’s Self-portrait with horn (1938) soars to $22.5m (£15.8m) at Sotheby’s New York. The painting was bought by cosmetics supremo Ronald Lauder for the Neue Galerie, a new museum of German and Austrian art, where it is now on show.

July: Sotheby’s attempt to jump the gun and hold a sale in its Paris premises is blocked by a last-ditch legal injunction brought by French auctioneers. The sales, of French furniture and books, are moved at the last minute to the premises of Poulain Le Fur.

Bonhams & Brooks announces that its merger deal with Phillips’s UK operation, which is owned by LMVH. The new company, Bonhams, will be owned 49.9/50.1% by LMVH and Louman Brooks; Robert Brooks is the new chairman. The move means the virtual disappearance from Britain of the 200-year old auction house name of Phillips.

August: France finally reforms its auction system, ending a 400-year old monopoly.

September: In the wake of the terrorist attacks on the World Trade Center, a number of art fairs and auctions are cancelled. Art losses from the attacks are thought to stand at $100m (£68m), according to AXA Nordstern Art Insurance; a major collection of Rodin sculptures was destroyed. The Dorotheum, Austria’s oldest auction house, is bought by a two-year-old online auctioneer, OneTwoSold.

November: Fears that the art market would be severely hit by the 11 September terrorist attacks prove unfounded. The main New York auctions are strong, if selective, although total proceeds were down compared with the previous year. The Gaffé Collection, sold at Christie’s for the benefit of Unicef, doubles pre-sale expectations and making $73m (£51m). Phillips does well with the Hoener and the Smooke Collection, but achieves this by offering high guarantees to vendors, and despite making over $100m (£70m) in just two sales is thought to have lost at least $60m (£42m) on the Smooke sale.

The final barricade around the French auction market falls and Sotheby’s holds a triumphant first sale in Paris; Christie’s follows a week later.

December: A. Alfred Taubman is found guilty of colluding to fix prices with Christie’s: he faces up to three years in prison and a heavy fine when he is sentenced on 2 April, 2002.

• Originally appeared in The Art Newspaper with the headline "1991-2001: a decade in the art market"