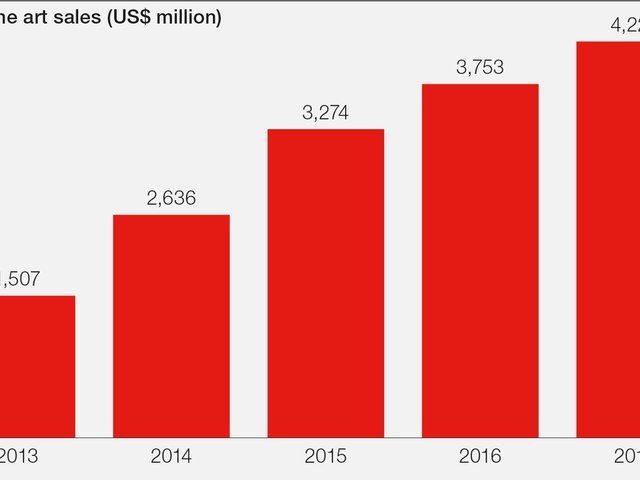

Bucking the downward trend in the wider art market, which last year saw a decline in reported sales, the online art market grew by 24% to $3.27bn, according to a study released by Hiscox fine art insurers on 19 April. Given that the majority of online art transactions still take place at $10,000 or less, the report suggests the lower end of the art market has been less affected by the global slowdown than the top and middle tiers.

“Online art buyers are currently most comfortable at the bottom end of the price scale and while bricks and mortar dealers still manage to eke out an existence, it is hard to see them prospering without an online strategy,” says Robert Read, the head of fine art at Hiscox. According to the report, 39% of galleries do not have an ecommerce strategy.

For the first time this year, Hiscox asked buyers to rank online art platforms. Christie’s was voted top overall and Sotheby’s fourth. Artsy and Artnet came in at second and third respectively. Sotheby’s decision to launch online-only sales in 2015 seems to be paying off; it reported internet sales exceeding $100m for the first time this year. The number of online buyers at the firm increased by 39%. Online sales at Christie’s fetched just under $40m, with online buyers up 10%.

Traditional auction houses are facing stiff competition from online companies such as Auctionata and Paddle8, which more than doubled sales last year. Invaluable, the auction aggregator that recently launched fixed-price sales (rather than the live “bid now” model) increased its online sales by 60%.

Dealers, however, are “struggling to deal with the online challenge”, Read says in his foreword to the report. “[They] remain insulated from reality as the traditional model still works (just about) and most are too small to take such a high risk gamble—probably a case of damned if they do and damned of they don’t.”

According to its gallery survey, last conducted by Hiscox in 2013, 28% of galleries said they now offered their clients the option to buy and pay online—up from 22% three years ago. One of the main obstacles facing dealers is the lack of interaction between sellers and buyers online, which goes against the grain of the relationship-based gallery model.

However, more people are buying from online art marketplaces (up from 21% in 2015 to 41% in 2016) than online auctions (up from 23% in 2015 to 37% in 2016). The option to “buy now” at a fixed price seems to be more appealing than the “bid now” model and could force online auction houses to move in this direction. A number of firms including Auctionata, Christie’s and Bukowski’s already offer fixed-price options on some sales.

Predictably, the number of people buying art on a mobile device has grown in the past year. As much as 45% of Invaluable’s web traffic came from mobile, while Artsy has seen traffic to its mobile website and apps triple in the past 12 months, according to the report. Its three highest priced sales were all brokered after collectors made inquiries through apps, including a $1.4m sale by a London gallery to a collector in the US.