Christie’s and Sotheby’s are emerging as the frontrunners in the online art market, according to the annual report by the fine art insurer Hiscox, released today, 25 April.

Christie’s online business increased by 34% in 2016 (from $162m to $217m), while Sotheby’s equivalent activities grew 19% to $155m, according to the Hiscox Online Art Trade Report, produced in association with ArtTactic. It ranks the auction houses first and second respectively in a poll of 758 art buyers. Last year Christie’s was voted top overall and Sotheby’s fourth.

Christie’s alone saw an 84% hike in online-only sales in 2016. Nonetheless, online represented just 1.5% of all sales at the auction house last year.

Sotheby’s, Christie’s and the Dallas-based Heritage Auctions, which specialises in collectibles, made a combined $720m in online sales, accounting for 19% of the digital art market in 2016. The figures suggest that power is shifting back towards more established models. “The future of the online art market is one dictated by the existing traditional players rather than a new online-only player,” the report says.

The recent demerger of online-only auctioneers Auctionata and Paddle 8 after less than a year backs this conclusion up. An investor has bought back the New York-based Paddle8, while the Berlin-based parent company Auctionata has filed for preliminary insolvency. “[This] recent failure… questions the ability of new online-only players to grow fast enough and become profitable in an increasingly congested marketplace,” the report says.

Instagram is also powering ahead of its rivals. The photo-sharing app overtook Facebook as the most popular social media platform, with 57% of art buyers saying that Instagram is the most frequently used, up from 48% in 2016 and 34% in 2015. Instagram is also the gallerists’ choice: 57% say the platform is the most effective for publicity.

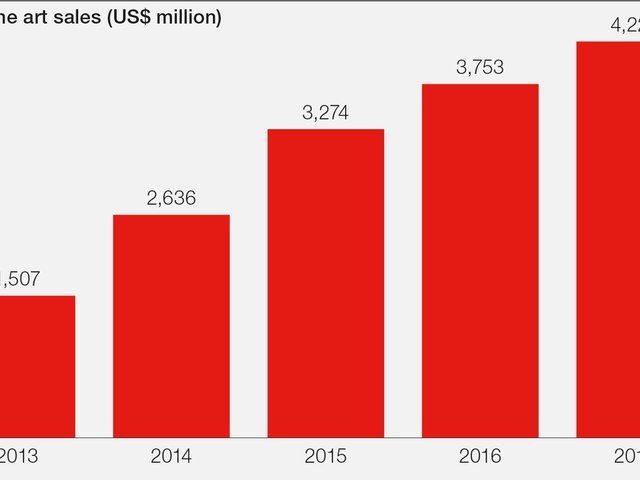

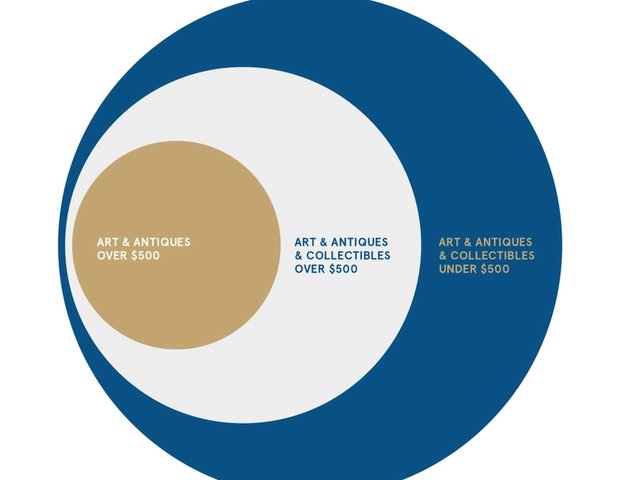

Overall the online art market grew 15% year on year to $3.75bn in 2016 and now accounts for 8.4% of the whole art market. Lower value works continue to dominate, with the vast majority of online sales done at below $5,000.