The future plans for the online data company Artnet now that it has been bought by the investment company Beowolff Capital Management have yet to materialise. But the deal, which values the company at around €65m, is a reminder of the impact that Artnet, and notably its database of all auction lot prices since 1985, has had on the art market—as well as a sign of its limitations in today’s more fragmented world.

Launched in 1990 by the Hamburg-based Modern art dealer Hans Neuendorf, the availability of all past prices coincided with, and contributed to, a surge of money into art. “It was a disruptive moment. The 21st-century category in particular was flooded with new interest from bankers and other financial guys,” says Caroline Sayan, the president and chief executive of the art advisers Cadell North America, who was at Christie’s at the time.

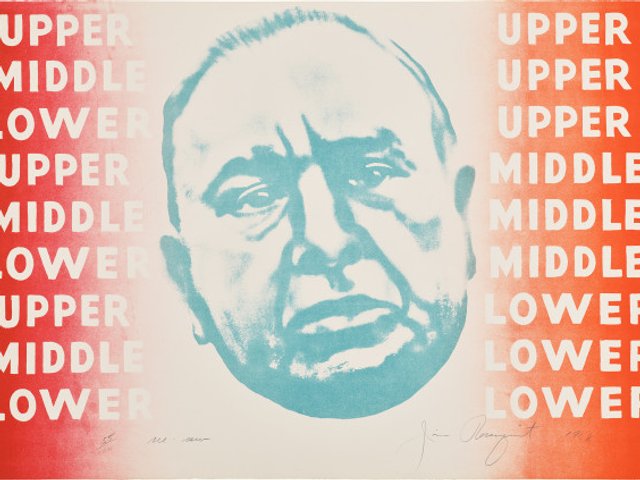

The combination of new money being made in financial services, its taste for the artists of the day and the availability of information that made art look like it could behave like stocks and shares created the ‘art as an investment’ craze that has pretty much dominated this century. Suddenly, it was possible to chart a previously opaque industry and create graphs that showed the gains of certain artists or movements. An industry of analysts, advisers, lenders and funds was able to build itself quickly around the numbers. Never mind that the data was selective and easy to manipulate, or that past performance, particularly in an area as complicated as art, was in no way an indication of what could come next. Even Neuendorf proved conflicted by what Artnet had unleashed, expressing regret to me (in the Financial Times) in 2019 that “everything is about the numbers and not about the art”.

Yet Artnet’s transparency was also welcome. Auction houses and dealers lost a chunk of the asymmetry of information that had served them well, hence their initial objections (and threatened lawsuits). Suddenly their inside knowledge was available to all, for a fee, and many in the market—including yours truly—use the database every day.

Privatisation and personalities

Artnet’s capture of just 50% of the market (as it accounts for only auction sales) was never the whole story—rather, it was a good enough indicator. Now that art can be bought via anything from TikTok to an exclusive private auction, even talk of pooling auction prices with the gallery data from Artsy (now majority owned by Beowolff) seems limited in its potential.

Artnet’s protracted road to privatisation was as much about personalities as its business model, but the truth is that even its database, the jewel in its unwieldy crown, is no longer compelling enough in this market. For a start, finding an individual auction price can be done through Google, and presumably AI will soon be able to amalgamate these all into an apparently compelling investment story.

Meanwhile, the quarter-century-old myth of art as an investment is fading. Market disruption is no longer about putting prices to pieces. It’s about converting the millions of NextGen enthusiasts into buyers, or at least spenders, in a way that somehow keeps artists going. The information is free. Monetising art now needs more imagination.