After two years of muted results, New York’s leading auction houses expect to pull in between $1.7bn and $2.3bn during their marquee November sales. A result near or above the high end of that range would support optimistic prognostications last month coming out of Frieze London and Art Basel Paris that the trade is turning a corner after a years-long slump. A significantly lower tally might suggest that would-be buyers are still holding off on making major acquisitions even when genuinely exceptional works are on offer. The likeliest outcome, somewhere in the middle, will give the trade plenty to mull over as it prepares for the last dance of 2025, Art Basel Miami Beach, in early December.

The surge in top-tier material headed to auction this month is largely driven by major consignments to Sotheby’s, including works from the estates of Leonard Lauder and Jay and Cindy Pritzker, as the auction house prepares to hold the first sales at its new headquarters, the Breuer Building.

Auction houses were among the businesses hit hardest when the art market began to slump in 2023. According to the Survey of Global Collecting 2025 released by Art Basel and UBS in October, the share of high net-worth individuals buying through auctions dropped from 74% to 49% over the past two years, with most of those collectors preferring galleries or private dealers. Still, auction house specialists say they are optimistic about this season’s offerings.

“Time is changing, and I’m feeling a movement. You see it in our sales, and you see it also in the competitive sales,” says Alex Rotter, Christie’s global president. “You see amazing quality of art, and what happened quietly behind the scenes is repricing. So what you suddenly have is amazing works that are priced correctly, and are priced invitingly.”

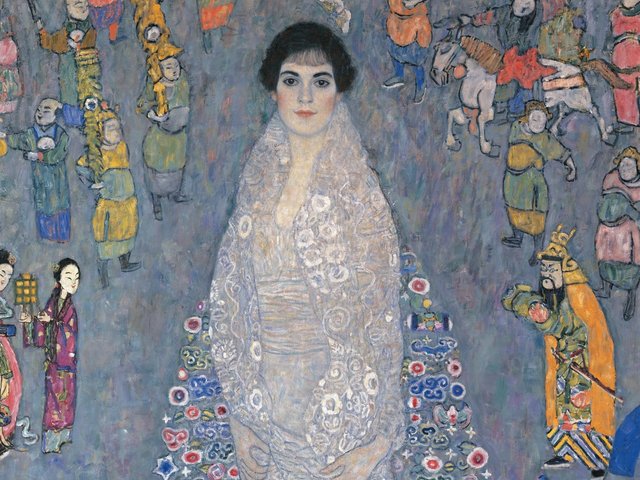

Sotheby’s new showroom

Sotheby’s fourth-floor Breuer galleries, featuring (left to right) Gustav Klimt’s Blooming Meadow (Blumenwiese), Portrait of Elisabeth Lederer (Bildnis Elisabeth Lederer) and Waldabhang bei Unterach am Attersee (Forest Slope in Unterach on the Attersee), from the Leonard A. Lauder collection Photograph by Stefan Ruiz. Courtesy of Sotheby's

Sotheby’s has the largest number of sales this month and expects them to bring in between $863m and $1.175bn. The auction house has also just moved its headquarters into the former Whitney Museum of American Art building on Madison Avenue in a reportedly $100m transaction, not accounting for renovations.

“For us, it’s such an important season,” says Madeline Lissner, Sotheby’s executive vice president of global fine art and major collections. “We’re moving into an iconic building at the Breuer. This reverberated with a lot of sellers being able to display their collection in a museum-style setting, which is really unique and not something that has been done before.”

The most outstanding consignment of the season is the group of 55 works from the late cosmetic billionaire Leonard Lauder’s estate, estimated to bring in around $400m alone. The collection is led by Gustav Klimt’s Portrait of Elisabeth Lederer (1914-16) which, with an estimate of around $150m, is the highest-valued lot of the past several seasons. Two additional Klimts from Lauder’s collection, Blooming Meadow (1906) and Forest Slope in Unterach (1917), carry estimates of $80m to $100m and $70m to $90m, respectively.

Another 37 works that belonged to the late Chicago-based collectors Jay and Cindy Pritzker are expected by specialists to collectively bring in around $120m. The Pritzker works are led in value by Vincent van Gogh’s Romans Parisiens (Les Livres jaunes) (1887), a still-life of a stack of books with a $40m estimate.

Frida Kahlo, El sueño (La cama), 1940, est $40m-$60m Courtesy Sotheby's

Another highlight of Sotheby’s sales is Frida Kahlo’s 1940 canvas El Sueño (La Cama), estimated between $40m and $60m, which could set new records for both the artist and any Latin American work at auction. El Sueño (La Cama) is part of the Exquisite Corpus sale, a single-owner collection of Surrealist work.

The buzziest consignment of the season may be Maurizio Cattelan’s fully-functional gold toilet, America (2016). Bidding for the work—crafted from solid 18-karat gold and modeled after a standard Kohler toilet—will begin at the current market value of the gold used in the sculpture, estimated at around $10m based on its weight, according to Sotheby’s. Multiple outlets have reported that the consignor is the billionaire collector and New York Mets owner Steve Cohen; a Sotheby's spokesperson declined to comment on the seller's identity.

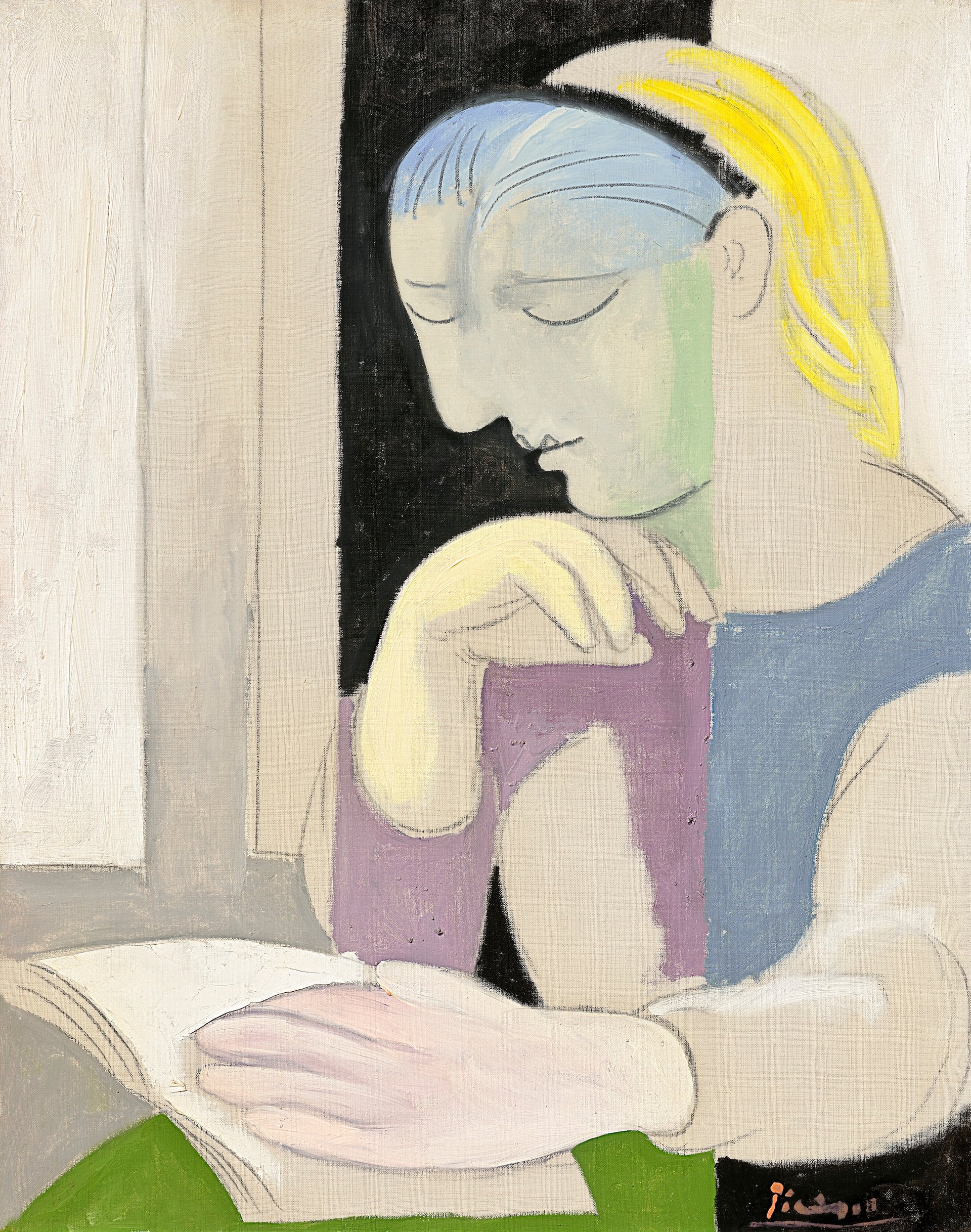

Christie’s classic Modernists

Pablo Picasso, La Lecture (Marie-Thérèse), 1932, est $40m Courtesy Christie's Images Ltd

At Christie’s, total estimates for the season’s sales range from $736m to $1bn. The house’s most valuable consignment is the Weis family collection. The supermarket magnate Robert F. Weis and his wife, Patricia G. Ross, acquired art for more than seven decades and quietly built a world-class collection. The couple’s children are selling 80 works from the collection this month, estimated to bring more than $180m. The leading lot is Mark Rothko’s No. 31 (Yellow Stripe) (1958), estimated at $50m, followed by Pablo Picasso’s La lecture (Marie-Thérèse) (1932), expected to bring around $40m.

Christie’s will also offer more than a dozen works from the collection of the late hotelier Elaine Wynn, which are expected to exceed $75m in total. Highlights include Lucian Freud’s The Painter Surprised by a Naked Admirer (2005) and Richard Diebenkorn’s Ocean Park #40 (1971), each estimated to sell for between $15m and $25m. Christie’s will also sell Claude Monet’s Nymphéas (1907) from the Kawamura Memorial DIC Museum of Art in Japan, estimated at more than $40m.

“It’s quite exciting and refreshing to have so much estate material that has been hidden away for decades, and some of it is a real revelation,” says Emily Kaplan, Christie’s co-head of 20th century evening sale, post-war and contemporary art. “The freshness of that material and the attractiveness of the pricing has generated a good amount of excitement and early interest from a lot of different clients.”

Christopher Wool, Untitled (RIOT), 1990, est $15m-$20m Courtesy Christie's Images Ltd

One of the most exciting collections of the auction season is that of Stefan Edlis and Gael Neeson, Chicago-based collectors known for their sense of humour and penchant for acquiring challenging work. The top lots by value from the Edlis-Neeson collection include Andy Warhol's The Last Supper (1986), carrying an $6m to $8m estimate. The collection will be sold as part of Christie's 21st Century evening sale, led by Christopher Wool’s Untitled (Riot) (1990), estimated to sell for between $15m to $20m. Kathryn Widing, Christie’s head of 21st century evening sale, notes that the house’s sales of 21st-century art feature less contemporary work than in years past, reflecting a concerted effort to follow bidder behavior amid the art market slump.

“When I was putting the sale together, I tried to be extremely thoughtful and strategic about how to respond to the market,” Widing says, adding that the season’s auctions have “more of a blue-chip focus and less of an emerging focus. It does not mean those clients are not collecting emerging—they still very much are—they're just not looking to the secondary market for emerging as much.”

Phillips and Bonhams bring Bacon, Hockney and an endearing dino

Phillips is projecting $48.25m to $68.6m in sales this month, slightly down from last year’s estimates, but the house’s chairman and head of Modern and contemporary art, Robert Manley, remains confident. “People are seeing the undeniable strength of the market, and I think there’s going to be quite the crescendo in November,” he says.

Phillips’s Modern and contemporary evening sale on 19 November will be led by Francis Bacon’s Study for Head of Isabel Rawsthorne and George Dyer (1967), estimated to sell for between $13m and $18m. In a twist, the auction will also include a near-complete fossilized skeleton of a juvenile Triceratops nicknamed “Cera”, estimated to sell for between $2.5m and $3.5m. The auction house will hold an additional day sale called Out Of This World, dedicated to fossils, meteorites and other objects from the natural world; the market for such objects has “exploded” over the past decade, Manley says.

Cera, a juvenile triceratops skeleton, est $2.5m-$3.5m Courtesy Phillips

“It’s brought a huge number of people that we’ve never interacted with before,” Manley says about collectors of scientific specimens. “What’s also been great for me is, as I’ve been doing the outreach to my usual art collectors, I'd say half of them say, ‘I can't wait to see that triceratops.’”

At Bonhams, this month’s sales are expected to exceed $25m. Top lots include Jeff Koons’s Balloon Venus Dolni Vestonice (Magenta) with a $1.5m to $2.5m estimate, and David Hockney’s large-scale watercolour Courtyard, Palace of Carlos V. Alhambra, Granada (2004), which is expected to achieve between $1.2m and $1.8m. Of the 28 lots in the auction house’s evening sale (also on 19 November), six works are expected to break the seven-figure mark. Earlier that afternoon, the auction house will offer works from the personal collection of the late actor Gene Hackman, led by Milton Avery and Richard Diebenkorn.